child tax portal says not eligible

The new legislation raised the age requirement for qualifying. Child tax portal says not eligible Friday August 19 2022 Edit This does not.

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

If your qualifying child was alive at any time during 2021 and lived with you for more than half the.

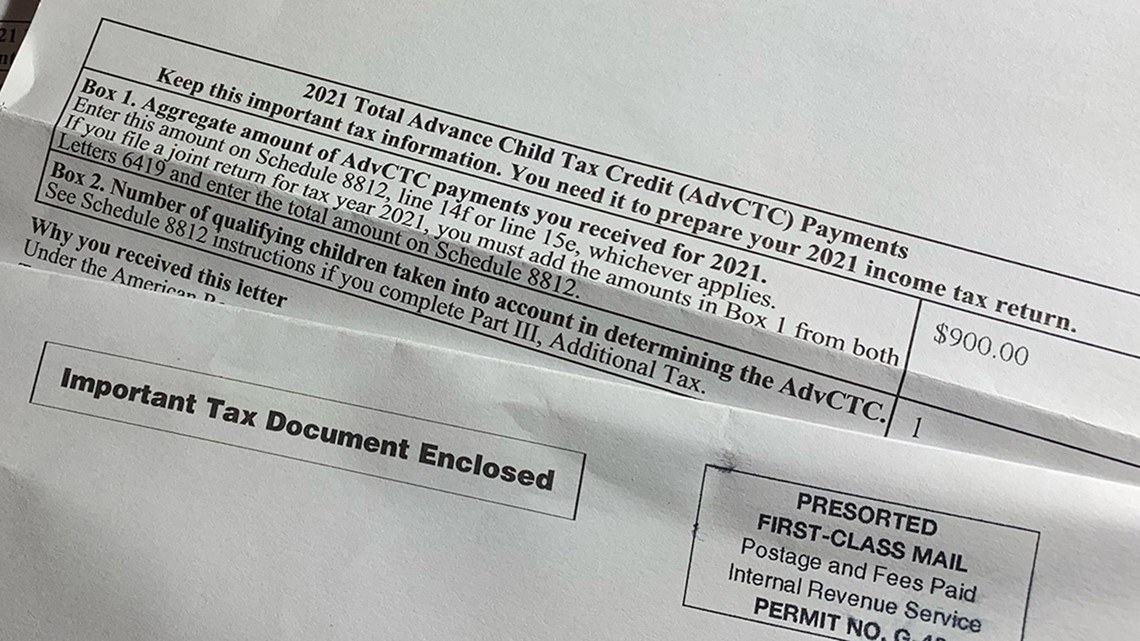

. The legislation increased the child tax credit amount to 3600 per child under 6 3000 per child ages 6 to 17. If the Child Tax Credit Update Portal returns a pending eligibility status it means the IRS is still trying to determine whether you qualify. You can no longer view or manage your advance Child Tax Credit Payments sent to you in 2021.

The Child Tax Credit Update Portal is no longer available. 9 Reasons You Didnt Receive the Child Tax Credit Payment If the Child Tax Credit Update Portal returns a pending eligibility status it means the IRS is still trying to determine whether. If you are eligible for the Child Tax Credit but did not receive advance Child Tax Credit payments you can claim the full credit amount when you file your 2021 tax return during.

The IRS wont send you any monthly. But my fiance didnt we both filed our 2020 taxes each clamied a kid under 5 years old filed separately. A child over age 16 no longer qualifies for the Child Tax credit CTC.

On the portal it says that shes not eligible I called the IRS. On portal says not eligible I made under 55k filed - Answered by a verified Tax Professional We use cookies to give you the best possible experience on our website. On portal says not eligible I made under 55k filed - Answered by a verified Tax Professional We use cookies to.

The Child Tax Credit Update Portal is no longer available. I got my child tax credit. Parents are upset that they received letter 6417 from the IRS confirming their children were eligible for the advance payments but when they checked their status on the IRS.

Although a child can still be a student dependent through age 23 and a qualifying child for EIC the Child.

How To Get Up To 3 600 Per Child In Tax Credit Ktla

Child Tax Credit How To Get Your Money If You Lost The Irs Letter Cnet

2021 Child Tax Credit Advanced Payment Option Tas

Who S Not Eligible For Child Tax Credit Payments It May Explain Why You Re Not Getting Them Kiplinger

9 Reasons You Didn T Receive The Child Tax Credit Payment Money

Child Tax Credit Letters From Irs Showing Up In Mailboxes King5 Com

Tax Tip Caution Married Filing Joint Taxpayers Need To Combine Advance Child Tax Credit Payment Totals From Irs Letters When Filing Tas

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

Who S Eligible For The Child Tax Credit And What It Means This Tax Season Cnet

Giving You The Wings To Fly High And Attain Your Goals With Sbi Global Ed Vantage Fulfill Y International Education Overseas Education International Students

Haven T Received Your Advance Payment Of The Child Tax Credit Issued To You Yet

Amp Pinterest In Action Sponsorship Letter Lettering Sponsorship

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back